Day 1-2

Enrollment

After signing up and submitting payment credentials for your billing you will be given instructions via your welcome email and welcome text message on the necessary steps needed to move along with the process.

Day 2-3

Sign Your Agreement

With your welcome messaging you will receive instructions on how to login into your customer portal. Approvology does not commit clients to a long-term agreement. Clients are enrolled on a month-to-month basis and reserve the right to cancel their membership at any time. Nevertheless, clients must sign with their digital signature in order to move forward in the process.

Day 2-3

Day 2-3

Proof of Identity

Upload photo copies of your proof of identification (one-by-one) in your secured client portal. These documents may include items such as your driver’s license, Passport, SSC, Tax Return, W2 and proof of address.

Day 2-5

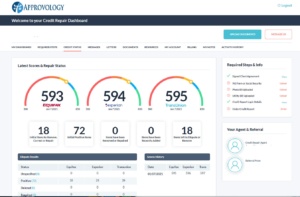

Setup Your Credit Monitoring Service

In order to help you with all your financial challenges, we must first be able to track and monitor the challenges on a regular basis. On nearly all our plans we include this service; however, you will need to help set it up. Your client portal and email communications will take you through this quick and easy process.

Day 2-5

Day 4-6

Let The Disputing Process Begin!

At Approvology, nothing makes us happier than to get our clients to this point! This is where the magic can finally begin! By this time, we have completed your credit report and score analysis and we are now preparing your file to begin the disputing process and mailing out your letters. Every client is different so we know that every dispute communication must be customized so that we can ensure we’re making the most out of every attempt in getting the best results.

Day 6-30

The Infamous “Waiting Game”

According to the Fair Credit Reporting Act, when a dispute is filed against a creditor you must allow that creditor a legal 30 calendar days to respond to the dispute. Patience & Persistence are our two most powerful tools we have in order to maximize your success and during this process. During this period of time the credit bureaus are working with both your creditors and collectors to investigate the accuracy of each account in dispute. In these early stages of the dispute process, there is nothing we can legally do to speed this process up. We will continue to be emailing, texting, and communicating with you on a regular basis. Should you have any questions or concerns, feel free to reach out via your customer portal to ask your Solutions Manager for support.

Day 6-30

Day 31-35

New Reports And Scores

This is the time for us to re-evaluate and strategize again with updated reports and scores. At this point of the journey you should be receiving correspondence in the mail from the credit bureaus regarding your first round of investigations. Please upload or forward any and all correspondence to our office by taking advantage of your customer portal. You should already be receiving automatic email & text alerts from our portal. *Please note, it is imperative that we disclose that while Approvology is very proficient in Credit Enhancement and Restoration, there is no guarantee that everything will be removed with every dispute submitted. Please know that our goal is to get your credit reports cleared up with all three major bureaus in the shortest period of time.

Day 36-44

“Wash….Rinse…. Repeat”

After we have reviewed your file as a whole, we will then follow up with all necessary credit reporting agencies, original creditors, and send debt validation letters to any remaining debt collectors. We repeat this process, month after month, until we get the desired results from the parties involved. The goal is to never take “no” for an answer and fight until you have won.

Day 36-44

Day 45-60

Start Adding New Credit

Now is an excellent time to start rebuilding and re-establishing your credit history with the credit bureaus. Luckily For you Approvology has it’s very own credit building tools and technologies. If you need advice as to where to start, please let us know.

Day 65 and Beyond

Ongoing Battle Until We WIN!

Each month, with each round, we get more and more aggressive until we are victorious. If you have questions about the process or what’s in store you can speak to your Solutions Manager for more details. Always Remember… Trust the process and continue to educate yourself.

Day 65 and Beyond

Graduation

The Future

There will be a time when either Approvology or you feel we have done everything we can. This is the the time to celebrate your graduation. We offer an Approvology Alumni program at a very affordable price to continue giving you access to credit monitoring, your scores, identity theft protection, the money manager, $1 MM family fraud insurance, and the score tracking builder & master. With this program in the event that another negative item appears, we will help you fix it anytime in the future! No other credit monitoring company offers that insurance.

Approvology™ is the science of helping improve lives with better credit. We are a group of dedicated professionals working together to make sure our customers achieve financial freedom.